Reminder! In observance of President's Day, there will be no school February 17th-18th. School will resume Wednesday, February 19th. Enjoy the long weekend!

We are thrilled to announce the opening of Hello Dolly on Valentine’s Day (Feb 14th)! 🎉 Thanks to an amazing collaboration between TFHS students and staff, this production is sure to be a night to remember. 💫

Special shout-out to:

Cameron Hoge & Roger Miskin in the Construction CTE program, for building the stunning set! 🔨🏗️

Mr. Child, our talented choir director, who is also serving as the music director for this amazing show! 🎶

Haven Elison, our gifted student choreographer, who choreographed almost the entire show—this senior deserves a lot recognition! 🌟

Show Details:

Dates: Feb 14, 15, 21, 22

Time: Doors open at 6:30 PM, Show starts at 7:00 PM

Ticket Prices:

$10 for adults

$5 for K-12 students

$35 for a family of 6

Come support the TFHS community and enjoy an unforgettable night of talent, teamwork, and creativity! 💃🎭🎶

#TFHS #CommunityCollaboration #SupportTheArts #StudentChoreography #Showtime #ValentinesDay #Theater #HighSchoolArts

We are looking for volunteers to help with decorating and cleaning up. Here's the link to that sign-up: https://www.signupgenius.com/go/10C0A45A4AE2EA5F5C70-54989211-valentines

Our Student Council is hard at work, spreading the word that kindness matters.

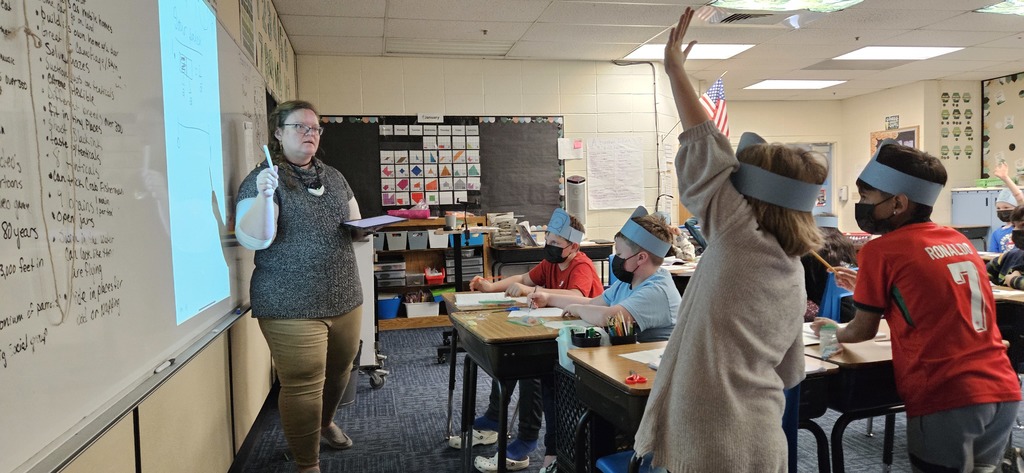

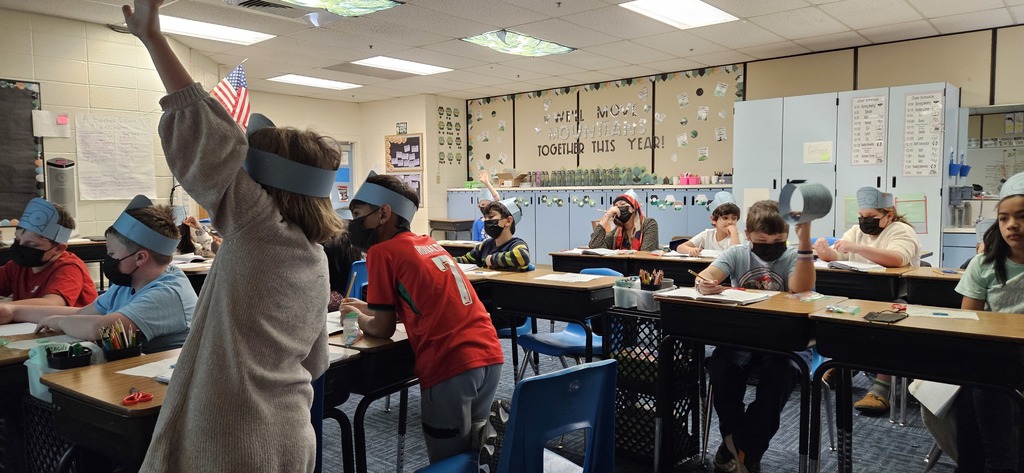

Mrs. Brown's class learned about fractions with a Sour Patch Kid Surgery Simulation!

Mrs. Lierman took advantage of the warmer weather with the kindergarteners and took the lesson outside.

Mrs. Dickard's class had so much fun on the hundredth day of school! (Last Friday)

Congratulations January Principal's Pride Winners! Thank you for being respectful!

Check out the most recent newsletter from the School Well-Being Program (free counseling and mental health navigation services) and BPA Health. We are proud to be able to offer these resources to our students and their families! https://conta.cc/49FOL8x

Do you love your child’s teacher? Has your child had a teacher who made an impact or who went above and beyond?

Here in the TFSD we are lucky to have an Education Foundation that helps recognize our outstanding educators. To do this, they organized a Teacher of the Month program that named one elementary teacher and one secondary teacher for this honor. If you know a great educator, please take a moment to nominate them for this honor. The nomination application is open now and can be accessed here: https://forms.gle/PE1ez3kuFwBN77rW6

We're thrilled to announce the new app for Twin Falls

School District! It's everything Twin Falls School District, in

your pocket.

Download for Android https://aptg.co/yvsj6c

Download for iPhone https://aptg.co/9SsmBR

There’s still time to make a difference! Homelessness impacts a child’s ability to learn, but with your support, we can provide the stability they need. Just $25 can provide hygiene supplies for a family, $75 can fund equipment for extracurriculars, and $150 can feed a student for a month. Let’s help them focus on learning, not survival. Donate before Dec. 31 to help TFSD reach our goal of $5,000. Every dollar helps! https://www.avenuesforhope.org/organizations/twin-falls-school-district #AvenuesForHope #LastChanceToGive #SupportTFSD

Meet a TFSD student who’s balancing schoolwork with the challenge of homelessness. “I do my homework at a local McDonald’s or coffee shop where I can get free Wi-Fi,” they shared. No student should have to struggle with finding a safe, quiet place to learn. Help us support students facing homelessness by donating to the Avenues for Hope campaign. Your contribution can provide food, supplies, and stability so they can focus on their education. Donate today: https://www.avenuesforhope.org/organizations/twin-falls-school-district #AvenuesForHope #SupportTFSDStudents

Extracurricular activities help students feel connected to their schools and friends—but for students experiencing homelessness, participating in sports or music programs can be difficult without proper gear. Your donation of $75 to the Avenues for Hope campaign could help provide a student with athletic shoes or the supplies they need to join in. Let’s work together to give every student a fair chance to thrive! Donate here: https://www.avenuesforhope.org/organizations/twin-falls-school-district #EveryDollarCounts #TFSDGivesBack

Congratulations Katie Schwabedissen, Certified Employee of the Month for December. Katie teaches language arts and Social Studies at O’Leary Middle School

Katie is a Twin Falls native who enjoys gardening and reading when she is not at work. Someday she would like to learn to speak Spanish fluently. She has always wanted to be a teacher. She loves working with kids and seeing them grow and change throughout the year. Her inspiration is when she sees her children being successful. Her best day on the job is when students from older grades (particularly graduating seniors) return to visit. She would like to be remembered as helpful to her students. A word that best describes her is caring.

Principal Note:

Ms. Schwabedissen is the manifestation of a master teacher. She cares deeply for her students and her curriculum. The last two years she has asked to have her 3 sections of Language Arts filled with the students that are struggling the most. She makes sure that there are accommodations that are appropriate for them but is still holding them to the same standards as the other teachers at the school. Her students showed great growth last year and I expect that this year’s students will be just as successful.

Imagine trying to finish your homework in a car or a crowded space with no privacy. That’s the reality for some of our students experiencing homelessness. TFSD is committed to ensuring all students have the resources they need to succeed in school, and we need your help. Every donation to the Avenues for Hope campaign will help provide essentials like food, hygiene supplies, and more. Let’s give these students a fighting chance! Donate here: https://www.avenuesforhope.org/organizations/twin-falls-school-district #AvenuesForHope #SupportTFSD

Happy Thanksgiving! We are so grateful for our incredible students, dedicated staff members, and the supportive community that makes public education thrive.

Wishing everyone a joyful and restful holiday! 🦃

🏀🎉 Gear Up and Give Back! 🎉🏈

Join us for a FREE Sports Gear Donation Drive! 🌟

📅 Date: November 15

🕕 Time: 6-8 PM

📍 Location: Canyon Ridge High School Cafeteria

Come collect the gear you or your kids need to play sports! We’re accepting new or gently used shoes, new athletic socks, and school sports gear—let’s help our community stay active and healthy!

Spread the word and bring your friends! Together, we can make a difference! 🙌💚 #GearUpGiveBack #CommunitySports #FreeGear

🎉🦸♂️ Big cheers for our superstars at Perrine! Students who showed incredible growth in reading and math ISIP were celebrated in style—wearing capes and racing through the halls while their peers cheered them on! What a fantastic way to recognize their hard work! 🚀📚

#SuperReaders #MathChampions #PerrinePride

🏀🎉 Gear Up and Give Back! 🎉🏈

Join us for a FREE Sports Gear Donation Drive! 🌟

📅 Date: November 15

🕕 Time: 3:30-5 PM

📍 Location: Canyon Ridge High School Cafeteria

Come collect the gear you or your kids need to play sports! We’re accepting new or gently used shoes, new athletic socks, and school sports gear—let’s help our community stay active and healthy!

Spread the word and bring your friends! Together, we can make a difference! 🙌💚

#GearUpGiveBack #CommunitySports #FreeGear